Konferens 2025:

Girighet, makt och pengarnas framtid

Välkommen till ett unikt globalt möte mellan ekonomer, jurister, journalister och aktivister som tillsammans utforskar hur vi kan skapa ett hållbart, rättvist och demokratiskt penningsystem.

Online, Zoom

Varför delta?

Vi lever i en värld av överflöd. Samtidigt har merparten av allt välstånd koncentrerats i händerna på ett fåtal. Hur har detta varit möjligt? Vilka krafter har drivit fram ojämlikhet, skuldsättning och finansiell instabilitet? Och vilka realistiska reformer skulle kunna skapa en ekonomi som fungerar för alla?

Under sju dagar kommer ledande ekonomer, jurister, journalister och reformatorer att förklara hur vårt finansiella system fungerar, varför vi behöver förändra det samt diskutera vägar framåt för att skapa en hållbar ekonomi som tjänar människorna och planeten vi bor på.

23 Talare

20 Sponsorer

Se konferensens trailer:

Oavsett om du är en politisk expert, aktivist, student eller en vanlig medborgare, är detta din chans att förstå systemet och hjälpa till bygga en ekonomi som gynnar alla.

Registrera dig nu!

Anmäl dig till konferensen för att säkra din plats.

* Genom att klicka på knappen godkänner du att Positiva Pengar & AMI mailar dig mer information om denna och kommande konferenser. Du kan när som helst sluta ta emot våra e-postmeddelanden genom att klicka på avsluta prenumeration.

Om konferensen

Vi är stolta över att presentera American Monetary Institute (AMI) 21:a konferens om penningsystemet. Temat i år är Girighet, Makt och Pengarnas framtid. Konferensen kommer att fokusera på kärnan i vårt samhälles problem: en ekonomi som drivs av girighet, där pengar skapas, kontrolleras och används som ett verktyg för privat vinning snarare än ett verktyg för det allmännas bästa.

Under två helger kommer konferensen att ta upp följande:

- Användningen av kapital som makt - hur företag och finanssektorn formar ekonomin, politiken och företagens prioriteringar.

- Privat skuldbaserat penningskapande - varför affärsbanker skapar cirka 99 procent av vår penningmängd genom lån och hur detta driver på ojämlikhet, högkonjunktur och miljöskador.

- Social och ekonomisk rättvisa - hur det monetära systemet lämnar miljontals människor utan bank och befäster skuldslaveri.

Konferensen är inte bara en exposé över problem - det är ett forum för praktiska, inspirerande lösningar om hur vi kan skapa ett penningsystem som gynnar alla.

Talare

Möt några av världens ledande röster inom ekonomi, juridik, politik och social rättvisa för att konfrontera grundorsakerna till ojämlikhet, finansiell instabilitet och överskuldsättning.

Schedule

The conference will have its Zoom sessions during two weekends:

- Friday September 19 5:30 pm – 9 pm CDT

- Saturday September 20 8:30 am – 1:30 pm CDT

- Sunday September 21 8:30 am – 1:30 pm CDT

- Tuesday September 23 2:00 pm – 3:30 pm CDT

- Friday September 26 5:30 pm – 10 pm CDT

- Saturday September 27 8:30 am – 1:30 pm CDT

- Sunday September 28 8:30 am – 2:00 pm CDT

All times Chicago, Central Daylight Time (CDT / UTC -5)

Friday, September 19

5:30 pm

Opening of the Conference

Steven Walsh

8:00 pm

Break

8:35 pm

Open Session

9:00 pm

Session Over

Saturday, September 20

8:30 am

Welcome

Steven Walsh

9:55 am

Break

11:30 am

Break

1:20 pm

Session Over

Sunday, September 21

8:40 am

Welcome

Steven Walsh

9:55 am

Break

11:00 am

Break

12:05 pm

Session Over

1:10 pm

Session Over

Tuesday, September 23

3:30 pm

Session Over

Friday, September 26

5:30 pm

Welcome

Steven Walsh

6:55 pm

Break

8:00 pm

Break

9:05 pm

Break

10:10 pm

Session Over

Saturday, September 27

8:40 am

Welcome

Steven Walsh

10:10 am

Break

11:45 am

Break

1:20 pm

Session Over

Sunday, September 28

8:40 am

Welcome

Steven Walsh

9:55 am

Break

11:15 am

Break

12:20 am

Break

1:25 pm

Open Session

2:00 pm

Session Over

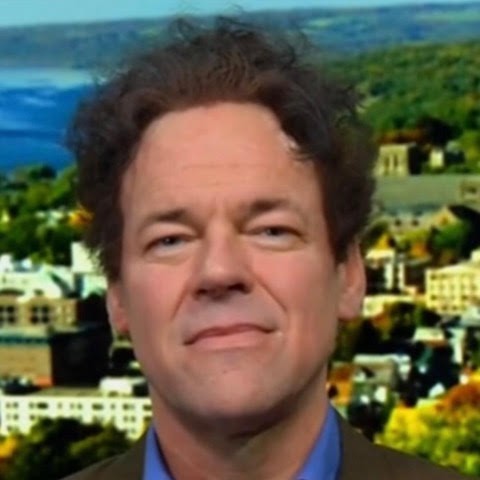

Robert Hockett

Professor of Law

10:00 am Saturday, September 20

Making Capital Democratic

The American Monetary Institute is a U.S.-based research and educational organization dedicated to the study of monetary history, theory, and reform. Founded in 1996, AMI’s mission is to end the private debt-based money systems that commercial banks and financial institutions have created since the start of central banking, and particularly over the last 55 years (Money Market Mutual Funds started in 1970). We need a public sovereign monetary system that serves the public interest rather than private banking interests.

AMI publishes research, organizes conferences, and provides resources on how money is created and managed, highlighting the risks of our present debt-based monetary system. The institute advocates for monetary reform based on the principles outlined in works such as The Lost Science of Money by its founder, Stephen Zarlenga.

Through its annual Monetary Reform Conference and public outreach, AMI brings together economists, academics, policymakers, and activists to discuss practical steps toward establishing a stable, debt-free monetary system that fosters economic justice and sustainability.

Co-sponsors

Bios and Abstracts

Kaoru Yamaguchi

Professor of Economics

6:00 pm Friday, September 19

Public Money: The Systems Solution to End National Debt, Banking Crisis, Built-In Inequality, Inflation and Control by CBDC

David Korten

Author and Activist

8:05 pm Friday, September 19

Why Monetary Reform is Essential to a Viable Human Future

Gretchen Morgenson

Senior Financial Reporter, NBC News Investigations

8:55 am Saturday, September 20

These Are the Plunderers: How Private Equity Runs—and Wrecks—America

A graduate of Saint Olaf College in Northfield, Minnesota, Ms. Morgenson worked as a stockbroker in New York City in the early 1980s, was a writer at Money Magazine later that decade and an assistant managing editor at Forbes Magazine in the 1990s. She is co-author, with Joshua Rosner, of “Reckless Endangerment,” a 2011 New York Times bestseller about the origins of the mortgage crisis. She is also co-author, with Rosner, of “These are the Plunderers,” a Wall Street Journal bestseller scrutinizing the world of private equity. Here, Gretchen Morgenson presents a deep dive into the way Wall Street Banks and Shadow Banking institutions fund private equity, Venture Capital, and Hedge Funds. In this highly acclaimed book - read by millions - Morgenson shows the dominance of private equity and its transformative effect in every sector of the economy.

Morgan Ricks

Professor of Management

11:35 am Saturday, September 20

Monetary System Design: Some First Principles

Bruce Woll

Adjunct in History at Temple University, Philadelphia

12:50 pm Saturday, September 20

Who is David Ciepley and Why He Matters

Leah Downey

Junior Research Fellow at St. John’s College, University of Cambridge

8:55 am Sunday, September 21

Our Money: Monetary Policy as if Democracy Matters

Mehrsa Baradaran

Professor of Law and the Associate Dean for Equity, Diversity & Inclusion at the University of California, Irvine School of Law

10:00 am Sunday, September 21

Neoliberalism and the Looting of America: How the Financial System increases the Racial Wealth Gap and Deepens Income-Based Class Inequality

Baradaran will also spotlight the role of neoliberal reforms in transforming financial institutions into engines of extraction rather than public service. By connecting these policies to lived realities—especially within marginalized communities—she reveals how the promise of opportunity has too often been replaced by cycles of debt, precarity, and dispossession. Yet her analysis is not only diagnostic but constructive: Baradaran will outline concrete policy pathways toward a more equitable financial system, one that democratizes access to credit, banking, and wealth-building tools. Her presentation challenges us to rethink money and banking as public goods essential to a just and sustainable democracy.

Sam Hummel

Graduate Student Economics

11:05 am Sunday, September 21

Building Multi-Issue Coalitions that Can Win Monetary Reforms

David Dayen

Journalist and Author

12:10 pm Sunday, September 21

How Wall Street Is Moving to Silicon Valley: How Financial Deregulation Led Wall Street to Monopolize the American Economy

Michael Hudson

Professor of Economics and Author

2:00 pm Tuesday, September 23

Temples of Enterprise: Debt, Finance, and Society from Antiquity to Today

Nick Egnatz

Author, Trustee for the American Monetary Institute

5:55 pm Friday, September 26

Introducing Monetary Reform on Spaceship Earth 101

history, and the urgent need for publicly issued money to save both people and planet. His latest work, Spaceship Earth 101, invites readers and audiences alike to rethink money as a tool for justice, democracy, and survival.

Adrian Kuzminski

Independent Scholar and Author

7:00 pm Friday, September 26

The People's Money: Reconsidering Populist Monetary Theory

Joseph Arminio

Doctor of Philosophy

8:05 pm Friday, September 26

The Dire Perils of Stablecoin

MIT awarded Arminio the Doctorate in Political Science. On the strength of his latest book, Dr. Arminio sounds the alarm regarding digital currency and stablecoin through his project Turning Point 2025, found at TURNINGPOINT25.org. Arminio’s author page is cfar21.org/sanmodpublishers. He lives in Wilmington, Delaware.

John G Root Jr

Author and Community Organizer

9:10 pm Friday, September 26

Money Issuance: The Primary Tool of the Sovereign

Gergely Szabo

Economist and Fund Manager

8:55 am Saturday, September 27

National Money – Shifting the Debate to the Next Level

Gábor Horváth

Senior Economic Expert at the Central Bank of Hungary

8:55 am Saturday, September 27

National Money – Shifting the Debate to the Next Level

Richard Robbins

Distinguished Teaching Professor Emeritus in the Department of Anthropology at SUNY Plattsburgh

10:15 am Saturday, September 27

Mean, Stupid Money: How Finance Used The Monetary System to Destroy the American Dream and How We Can Bring It Back

While we sometimes hear complaints about the salaries and bonuses captured by Wall Street executives and corporate CEOs, investment finance—the process of making money with money—receives a relatively free ride from those trying to explain the explosion of economic inequality in the U.S., the political polarization destroying civic life, and the phenomenon of a six-times bankrupt billionaire real estate investor upending the rule of law. This paper will outline how the increasing share of wealth captured by investors over the past four decades impoverished millions while, at the same time, creating a class of billionaires with the financial and political power to reshape our society in their image. It will also offer a political strategy to bring finance and money back to the constructive role that it once played in the realization of the American dream.

Les Leopold

Author and Labor Advocate

11:50 am Saturday, September 27

What Can and Should Be Done About Mass Layoffs? And How Do We Understand 'Wall Street’s War on Workers'

Geoff Crocker

Economist, Author, and Policy advocate

8:55 am Sunday, September 28

Rethinking Income and Money: Incorporating Technology Into Economic Theory

Oliver Heydorn

Director of the Clifford Hugh Douglas Institute for the Study and Promotion of Social Credit, Canada

10:00 am Sunday, September 28

Douglas Social Credit: Restoring Honesty and Functionality to the Financial System

Mario Martinez

Economist, Activist, and President of Dinero Positivo

11:20 am Sunday, September 28

Can Money Creation Be Much Simpler? Untangling Public And Private Roles - Unleashing Prosperity For All

change everything about how money works.

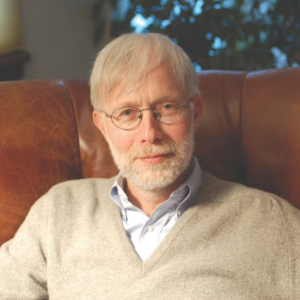

David Ciepley

Associate Fellow at the Institute for Advanced Studies in Culture, University of Virginia

12:25 pm Sunday, September 28

After Neoliberalism: Toward a Stewardship Economy

Over time, whoever controls the money system, controls the nation.

Stephen Zarlenga

(1941 – 2017)